Foreign banks

are scrambling to raise dollar deposits from non-resident Indians —

even tempting them with loans — to open their foreign currency

non-resident (bank), or FCNR (B), deposit accounts in India.

The move comes after the Reserve Bank of India (RBI), as part of its efforts to stem the rupee’s depreciation, opened a special window for swapping FCNR (B) dollar funds of three years or more at a concessional rate and offered various other incentives, including cheap dollar-rupee swap rates.

Observers say this has offered Indians residing abroad an opportunity to increase their income manifold using borrowed capital.

The process, as bankers and market participants explains, begins with a

foreign bank requesting a non-resident to open a FCNR (B) deposit

account with its India unit. The bank immediately offers the customer a

loan against this deposit. The customer uses the loan to create another

FCNR (B) deposit account, against which he is again given a loan. The

process is repeated eight to 10 times. The customer benefits as he earns

more interest on FCNR (B) deposits than he pays on loans against those.

Some of the Indian banks with foreign branches have also approached

their non-resident customers to raise FCNR (B) deposits, but observers

say these lenders are not as aggressive as their foreign rivals.

Industry analysts say, using this mechanism, non-resident Indians (NRIs)

can make a net return that is significantly higher than the interest

rates offered on deposits in developed markets like the US. The returns

would easily lure NRIs. According to some estimates, by putting up just

10 per cent of the deposits, the client effectively makes between 18 and

21 per cent on the dollars.

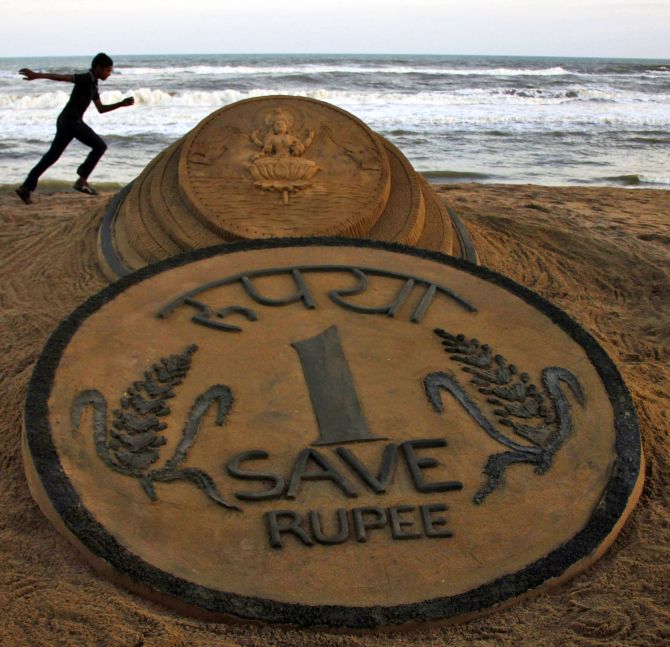

On September 4, 2013, in an almost desperate move to arrest the slide

the rupee, RBI had announced a window for swapping FCNR (B) dollar

funds, mobilised for a period of at least three years, at a fixed rate

of 3.5 per cent a year for the duration of the deposit. The scheme, the

central bank had said, would remain operational until November 30, 2013.

In other words, the banking regulator is now permitting lenders to

convert three-year FCNR (B) dollar deposits into rupees at 3.5 per cent,

even though the swap cost, considering the recent rupee-dollar forward

rates, is estimated to be more than six per cent. This has encouraged

banks to mobilise FCNR (B) dollar deposits, as they can reduce their

cost of fund by at least 250 basis points using this window.

“It is a win-win situation for all. The interest rates offered to

non-residents on three-year FCNR (B) deposits in India are significantly

more than the current dollar swap rate of 80 basis points a year for a

comparable tenure. Banks will benefit, as they will have access to

low-cost funds. And, ultimately, this will increase dollar flows into

India,” Param Sarma, director and chief executive of NSP Treasury Risk

Management Services, says.

Market participants expect banks to bring in over $10 billion through

this route which will probably avoid the need for an immediate sovereign

bond issue by the government.

“The swap window was necessitated by a sharp depreciation in the rupee

and need to bridge the current account gap. There was a need for one

large chunk of dollar inflow, which probably led to the introduction of

this scheme. However, it is a subsidy, assuming the rupee-dollar swap

cost is currently over six per cent. This subsidy will have to be borne

by the country,” says Mecklai Financial Deputy CEO Partha Bhattacharyya.

Some industry analysts believe the subsidy burden on Indian taxpayers

because of this move might be as high as Rs 2,000 crore a year, assuming

banks bring in $10 billion of FCNR (B) deposits.

“We discontinued FCNR (A) deposits since we did not want to bear the entire currency risk, and these deposits also violated IMF

(International Monetary Fund) conditions. But by allowing swap at a

concessional rate of 3.5 per cent for FCNR (B), we are going back to the

FCNR (A) regime, at least partly. I believe, we should be explicit in

saying what would be the estimated cost of this subsidy, since the

deposits might run up to five years,” Ranade adds.

The process, however, has raised concerns of systemic risk.

“The 2008-09 crisis was triggered by over-leveraging. We are again

seeing foreign banks encouraging leveraging. There are reports that

lenders are offering NRIs upfront loans against FCNR (B) deposits and

repeating the process. Such leveraged money can leave as abruptly as it

comes in, thereby increasing systemic risk,” Ajit Ranade, chief

economist of Aditya Birla Group, says.

Prime Minister Manmohan

Singh sought to soothe worries about the economy on Friday, telling

parliament that the crashing value of the rupee was part of a needed

adjustment that would make Asia's third-largest eco

Prime Minister Manmohan

Singh sought to soothe worries about the economy on Friday, telling

parliament that the crashing value of the rupee was part of a needed

adjustment that would make Asia's third-largest eco But

he said that a weaker currency was the natural outcome of several years

of high inflation, and although the rupee had overshot in the foreign

exchange market its decline would bring some economic benefits.

But

he said that a weaker currency was the natural outcome of several years

of high inflation, and although the rupee had overshot in the foreign

exchange market its decline would bring some economic benefits.